Employer Student Loan Repayment Assistance

What is Student Loan Repayment Assistance?

Student loan repayment assistance is one of the fastest growing non-health employee benefits. It addresses the burden that student loan debt places on today’s workforce and helps employers compete for top talent.

Employers can make contributions toward an employee’s student loans or retirement account, reduce their financial stress, and improve workplace productivity and affinity.

Employer contributions to employee student loans up to $5,250 annually are income tax-free for the employee and payroll tax-free for the employer (through Dec. 31, 2025).

Student Loan Repayment Assistance Is One of the Fastest Growing Non-Health Benefits

In this highly competitive job market, student loan repayment assistance is a great benefit to offer. It's a win-win for employers seeking to build and maintain the highest quality team. The aspect known as student loan paydown benefit brings financial relief and shows employees you're willing to improve their quality of life. Did you know that over 50% of American workers say an employer-provided student loan repayment benefit would play a role in assessing job opportunities? (Source: SHRM) In offering student loan repayment assistance, employers can compete for and retain a quality workforce and improve productivity and engagement levels.

An unprecedented 65% of employees are looking for a new job; and 88% of executives said they’re seeing higher than normal turnover. (Source: PWC)

When Did Employer-Made Student Loan Payments Become Tax-Free?

The opportunity for an employer to make a tax-free payment toward employees’ student loans started with the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The legislation included a temporary provision permitting employers to amend Education Assistance Programs and pay up to $5,250 per year on a tax-free basis toward an employee’s loans.

Qualified education loans, both private and federal, obtained to pay for specific higher education expenses — including tuition, fees, room, board, books, supplies and other necessary expenses — are covered.

On Dec. 27, 2020, the Consolidated Appropriations Act, 2021 (CAA) was passed by Congress and signed by the President. One of its provisions was to extend the tax-free advantage of employer payments through Dec. 31, 2025. The CAA continued what the CARES Act started, affirming that SLRAs are here to stay (at least until 2026).

The CARES Act expanded the scope of Sec. 127 of the Internal Revenue Code, which addresses employer-paid tuition benefits. The CARES Act stipulated that the $5,250 employers can annually contribute tax-free for tuition assistance can be extended to student loan repayment assistance. According to Employment Law Worldview, an employer can “pay for all or part of an employee’s Qualified Education Loan as a tax-free benefit, provided that benefit is part of an employer’s Education Assistance Program.”

Student Loan Debt Burdens Many Americans

Student loans can be stressful regardless of age or income level. 62% said their student loan debt negatively affects their mental health. (Source: CNBC)

Balancing payments with other bills and financial commitments can delay key life achievements for many. Student loan repayment support programs allow employers to differentiate themselves and show they understand a major pain point in their employees’ lives.

Student loan debt may cause mild anxiety for some or be a huge stressor for others; it is the second-highest consumer debt category in the U.S., so the impacts on individuals and the economy are huge.

Average Student Loan Debt by Generation

(Source: EducationDataInitiative)

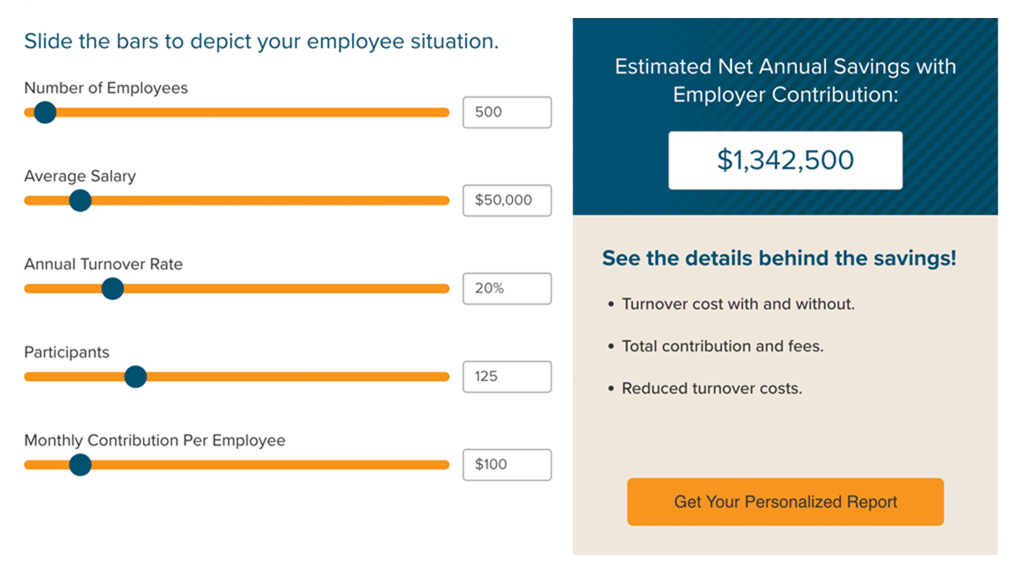

How Do You Calculate the ROI on Providing Student Loan Repayment Assistance?

The real question is whether you can afford not to offer student loan repayment assistance. It can easily pay for itself when you calculate that losing an employee costs 1.5-2 times their salary due to decreased team productivity, recruitment costs, new employee training, and hidden costs like reduced morale.

Check out our free Student Loan Repayment Assistance ROI Calculator to help you estimate turnover cost (with and without it), total contribution, fees, and turnover reduction.

Why Is Student Loan Repayment Assistance Better Than a Sign-On Bonus?

Sign-on bonuses come and go, they're taxable, and they lack an ongoing commitment from both the employer and employee. A student loan paydown contribution is tax-free for both the employee and the organization and payments are made directly to an employee's student loan, reducing their overall debt and total loan cost. Offering a student loan contribution can improve staff satisfaction and lead to employee retention as funds are disbursed month after month instead of in one lump sum. Further, organizations can tie the contribution amount to longevity or focus on providing the benefit to certain positions.

Why Is Student Loan Repayment Support Critical Now?

Student loan payments on federally held loans were suspended through the CARES Act beginning in March 2020. Multiple executive actions extended the pause through Aug. 30, 2023. Student loan interest began accruing again on Sept. 1, 2023.

43 million people resumed repayment at the same time.

Nearly 90% of borrowers didn't make a payment during the pause, and many never made a monthly student loan payment. (Source: NASFAA) Combine this with 16 million borrowers having had their loans transferred to a new servicer, with more transferring in the coming year, resulting in borrowers not knowing who to contact for help. (Source: CFPB)

In addition to shifting portfolios, student loan servicers are challenged by fewer and newer staff, changing policies, and reduced income. Demand for repayment support may be too high for loan servicers to accommodate. Borrowers may experience longer hold times, shorter customer support hours, and delays in paperwork processing.

As well, many borrowers have shared that they are struggling to make ends meet.

Now Is the Time to Add an Employee Benefit to Ease the Burden of Student Loan Repayment

This benefit is a win-win for your organization and your employees.

- Attract and retain top talent — standout among employers.

- Improve employee financial wellness.

- Enhance workplace productivity.

Ascendium provides comprehensive student loan benefits: student loan paydown, one-on-one personalized counseling, and self-help education in addition to informative webinar events — everything you need to help your employees more easily navigate student loan repayment. Contact us today to learn more.

Learn More About Student Loan Repayment Assistance

Download our free e-book, Employer’s Guide to Student Loan Repayment Assistance.

Estimate your return on investment using our free ROI Calculator.

Discover how Co-Pay Partners® makes it easy for organizations to implement student loan repayment assistance.

Still have questions? Check out our FAQs page.